House health care plan spares typical family from tax increases; hits wealthy hard

By Stephen Ohlemacher, APMonday, November 2, 2009

Health care plan hits rich with big tax increases

WASHINGTON — The typical family would be spared higher taxes from the House Democratic plan to overhaul health care, and their low-income neighbors could come out ahead.

Their wealthy counterparts, however, face big tax increases that could eventually hit future generations of taxpayers who are less wealthy.

The bill is funded largely from a 5.4 percent tax on individuals making more than $500,000 a year and couples making more than $1 million, starting in 2011. The tax increase would hit only 0.3 percent of tax filers, raising $460.5 billion over the next 10 years, according to congressional estimates.

But unlike other income tax rates, the new tax would not be indexed for inflation. As incomes rise over time because of inflation, more families — and more small business owners — would be hit by the tax.

“Twenty years from now, we’re going to see more and more small businesses ensnared into paying higher taxes,” said Rep. Dave Camp of Michigan, the top Republican on the tax-writing House Ways and Means Committee.

The tax would hit only 1.2 percent of taxpayers who claim business income on their returns, according to the estimates by the nonpartisan Joint Committee on Taxation. But that percentage would grow as business owners’ nominal incomes rise with inflation.

In 2011, a family of four with an income of $800,000 a year would get a $24,000 tax increase, when the new tax is combined with an increase in the top two tax brackets proposed by President Barack Obama and other scheduled tax changes, according to an analysis by Deloitte Tax. That’s a 12.5 percent increase in federal income taxes.

A family of four making $5 million a year would see a $434,500 tax increase, about a 32 percent increase, according to the analysis.

“These are very big numbers and very high effective tax rates,” said Clint Stretch, a tax policy expert at Deloitte Tax.

The new health care tax would come on top of other tax increases for the wealthy proposed by Obama. The top marginal income tax rate now is 35 percent, on income above $372,950. Obama wants to boost the top rate to 39.6 percent in 2011 by allowing some of the tax cuts enacted under former President George W. Bush to expire.

House Democrats said they are proud that they found a way to finance the health care package largely from a tax on the wealthy. There is, however, little appetite for a millionaire’s tax in the Senate, where some hope to eventually use tax increases on the wealthy to help close the growing federal budget deficit. Also, some tax experts think it is a mistake to tap only rich people to pay for services used by all.

“If health care is a benefit that is worth having, then it’s worth paying for,” said William Gale, who was an adviser to President George H. W. Bush’s Council of Economic Advisers and is now co-director of the Tax Policy Center. “This gives the impression that it’s only worth having if someone else pays for it.”

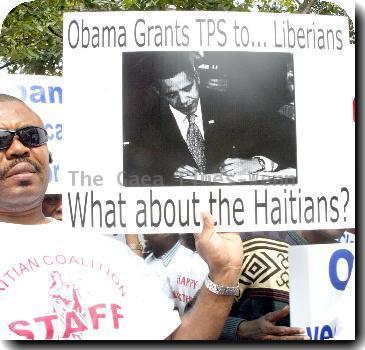

Obama promised during the presidential campaign that he would not increase taxes on couples making less than $250,000. However, the health care bill would impose new taxes on people who don’t buy qualified health insurance, including those making less than $250,000 a year.

Under the bill, individuals are required to obtain health insurance coverage or pay penalties, which are described as taxes in the legislation. The penalty would be equal to the cost of an average insurance plan or a 2.5 percent tax on incomes above the standard threshold for filing a tax return, whichever is less. There would be waivers for financial hardships.

To help afford insurance, families with incomes up to four times the federal poverty level would qualify for subsidies. The poverty level for a family of four is $22,050 this year.

Republicans argue that the penalties violate Obama’s tax pledge, and they liken the millionaire’s tax to the Alternative Minimum Tax, which Congress enacted in 1969 to ensure that wealthy Americans cannot use loopholes to avoid paying any income taxes.

The AMT was never indexed for inflation, so Congress must enact a fix each year to spare about 25 million middle-income families from being hit with big tax increases.

“They’re going down the same road by not indexing this tax,” said the Republican lawmaker Camp.

Tags: Barack Obama, Government Regulations, Health Care Industry, Industry Regulation, North America, Personal Finance, Personal Insurance, Personal Taxes, Prices, United States, Washington