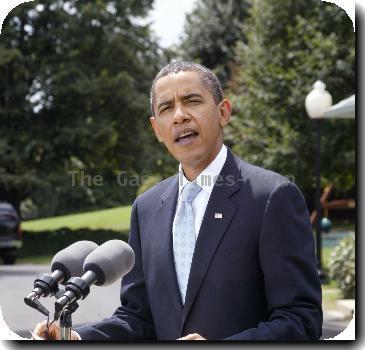

Obama to sign bill extending jobless benefits, homebuyer tax credit

By Jim Abrams, APFriday, November 6, 2009

Obama to sign homebuyer, jobless bill assistance

WASHINGTON — President Barack Obama is set to sign a $24 billion economic stimulus bill providing tax incentives to prospective homebuyers and extending unemployment benefits to the longtime jobless who have been left behind as the economy veers toward recovery.

The White House signing ceremony Friday comes a day after the House, displaying rare bipartisan agreement over the seriousness of the jobless situation, voted 403-12 for the measure. The Senate approved it unanimously on Wednesday.

The White House said the bill, which also includes tax cuts for struggling businesses, builds on provisions in the $787 billion stimulus package enacted last February that aim at spurring job creation.

Lawmakers stressed that the fourth unemployment benefit extension in the past 18 months was necessary because initial signs of economic recovery have not been reflected in the job market.

“The truth is that long-term unemployment remains at its highest rate since we began measuring it in 1948,” House Majority Leader Steny Hoyer, D-Md., said. About one-third of the 15 million people out of work have gone at least six months without a job.

The bill would provide another 14 weeks of benefits to all out-of-work people who have exhausted their benefits or will do so by the end of the year, estimated at nearly 2 million. Those in states where the jobless rate is 8.5 percent or above get an additional six weeks.

The Labor Department announced Friday that the jobless rate had risen to 10.2 percent, and that employers shed another 190,000 jobs in October.

The extra 20 weeks could push the maximum a person in a high unemployment state could receive to 99 weeks, the most in history. Unemployment checks generally are for about $300 a week.

The tax credits, added by the Senate, center on extending the popular $8,000 credit for first-time homebuyers that was included in the stimulus package. The credit, which was to expire at the end of this month, will be available through next June as long as the buyer signs a binding contract by the end of April.

The program is expanded to include a $6,500 credit for existing homeowners who buy a new place after living in their current residence for at least five years.

The credit, said Democratic Rep. Shelley Berkley of Nevada, a state particularly hard hit by the recession, “will allow more people to purchase a home in my district and help stop the continued downward spiral in housing prices caused by the foreclosure crisis.”

Prolonging the life of the homebuyer credit has been a priority of the real estate industry, which says it has been instrumental in beginning to turn around a market that was a major cause of the economic downturn. About 1.4 million first-time homebuyers have qualified for the credit through August, and the National Association of Realtors estimates that 350,000 of them would not have purchased their homes without the credit.

The other tax credit allows businesses that have lost money in 2008 or 2009 to get refunds on taxes paid on profits during the five previous years.

The Senate spent more than a month crafting the package and working out partisan fights over amendments, angering lawmakers and others who pointed out that 7,000 people lose their unemployment benefits every day. The National Employment Law Project estimated that 600,000 workers exhausted their benefits in September and October while Congress debated the legislation.

The lead sponsor of the bill in the House, Rep. Jim McDermott, D-Wash., reminded lawmakers that they’ll have to revisit the issue again before adjourning for the year. The bill applies to benefits exhausted this year, and “Congress must act again before the end of this year to continue the extended unemployment benefits that we are now improving.”

The more than $21 billion cost of the tax credits would be paid for largely by delaying a tax break for multinational companies that pay foreign taxes.

The cost of the unemployment benefit extension, about $2.4 billion, is offset by extending a federal unemployment tax that employers must pay.

The bill is H.R. 3548.

On the Net:

Congress: thomas.loc.gov

Tags: Barack Obama, Business And Professional Services, Home Buying, Labor Economy, Mortgage Figures, North America, Personnel, Real Estate, Recessions And Depressions, Residential Real Estate, Unemployment, United States, Washington